what are federal back taxes

Back Taxes Meaning The term back taxes refer to taxes that have not been fully paid and remain payable to the tax authorities To say back taxes is like saying that my taxes are. The IRS assesses back taxes one of three ways.

What To Do If You Owe The Irs Back Taxes H R Block

The same rule applies to a right to claim tax.

. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends. Tax Withholding on Lottery Prizes. Prefill and prior year info saves you time then your etax accountant handles the.

Causes for back taxes include failure to pay taxes by the. What Is Federal Tax Withholding. A rollback tax is collected when properties change from agricultural to commercial or residential use.

This is a one-time nonrefundable tax. This type of tax debt regularly accrues penalties and fines and. A taxpayer could have back taxes at the Federal State or even Local levels.

Brackets for 2021 range from 10-37. Your bracket depends on your taxable income and filing status. Why you should file back taxes.

Federal income tax must be paid as you earn or receive income during the year either through withholding or estimated tax. Back taxes are the taxes you owe to the Internal Revenue Service that was wholly or partially unpaid the year they were due. Back taxes are any taxes that you owe that remain unpaid after the year that they are due.

Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in your home after December 31 2021. First the back taxes are typically the result of a filed but unpaid federal income tax return. You can owe back taxes at the federal state or local level and you can owe them.

Basically federal tax withholding is where your employer takes a certain amount of money out of your paycheck for taxes and sends it to the. The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Simply put back taxes are taxes that still have a balance due or were only paid partially.

Federal income tax is levied by the IRS on the income of individuals businesses and other legal entities. Federal income tax returns are typically due each year on April 15 for the prior year. Typically these are taxes that are owed from a previous year.

If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date. State lottery agencies are required to withhold 25 percent of your winnings for federal income taxes if the total prize minus your wager is more than 5000. There are seven federal tax brackets for the 2021 tax year.

Back taxes refer to an outstanding federal or state tax liability from a prior year. Back taxes refer to an outstanding federal or state tax liability from a prior year. Back taxes are taxes that werent paid at the time they were due typically from a prior year.

Pay Your Tax When You Earn Your Income. And if you owe them you might be wondering about tax relief. When taxes are delinquent or overdue typically from previous years they are referred to as back taxes.

This means that a taxpayer filed his or her federal. Back taxes is a term for taxes that were not completely paid when due. 10 12 22 24 32 35 and 37.

They are based on the difference between the tax paid and the tax that would. Basically if you let an entire filing year go by without paying the IRS what you owe its.

What Are Back Taxes And How Do I Get Rid Of Them Bc Tax

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Tax Debt Here S How To Handle Outstanding Federal Obligations

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Bankruptcy And Taxes Archives Irs Office Near Me

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Do You Still Receive Your State Refund If You Owe Back Taxes On Your Federal Taxes

Federal Income Back Taxes Income Tax Rates And Brackets

How To Get Irs Tax Relief The Complete Tax Resolution Guide For Irs Back Tax Problems Settlements Offer In Compromise Payment Plans Federal Tax Liens Levies Penalty Abatement And Much

9 Takeaways On Businesses With Back Taxes Getting Federal Aid 9news Com

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

New Tax Law Take Home Pay Calculator For 75 000 Salary

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Understanding What Is Irs Ability To Pay Agreement And How It Impacts Back Taxes Reductions

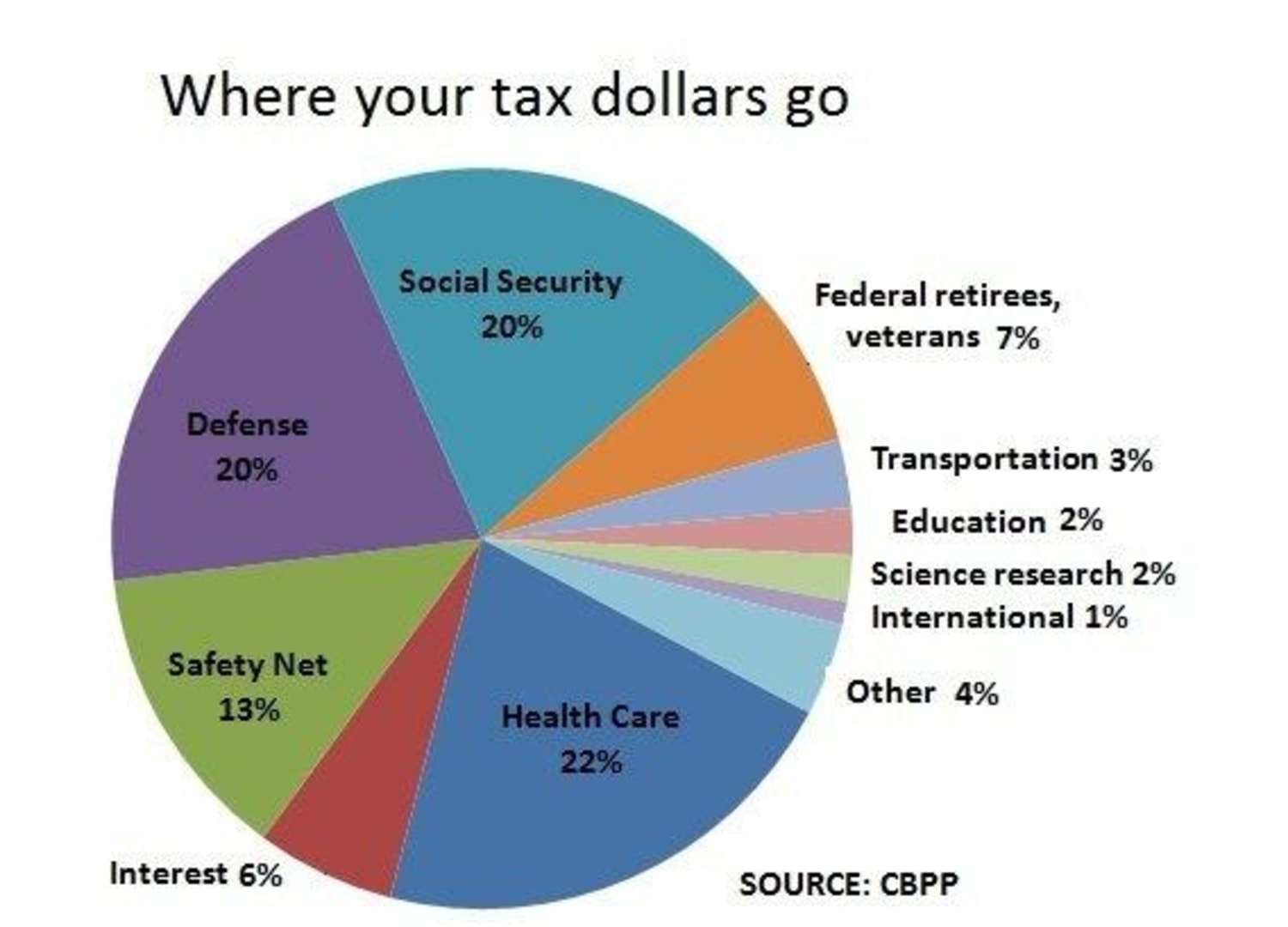

Here S Where Your Federal Income Tax Dollars Go